A hunting ground for investors: The changing face of the financial and insurance sector

June 23, 2025

June 23, 2025

Article by Robert Young, Senior Investment Director and Ryan Lloyd, Investment Analyst for Private Equity at Patria Investments

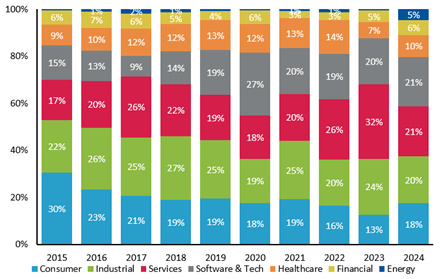

The Financial & Insurance Groups (“FIG”) sector has been a staple of the private equity (PE) market for several decades. Whilst other sectors have come into vogue in recent years, accounting for an increasing share of private equity deals, FIG’s share of the overall market has remained relatively stable, representing around 5-7% of deals completed.

Figure 1: Breakdown of European private equity buyouts (Baird, 2025)

Traditional FIG has long been a relatively ‘unfashionable’ market. This was particularly true following the 2009 financial crisis, during which many traditional financial services businesses experienced significant volatility, followed by increased regulatory scrutiny and a prolonged period of near-zero interest rates. However, perception has been improving over time as private equity players have increased their activity in asset-light businesses in the sector. These often sit at the intersection of FIG and technology or services, and possess desirable characteristics for PE investors, such as low capital intensity, high margins and fragmented markets, creating scope for a buy-and-build strategy. They also tend to be regulatory-light compared to traditional FIG businesses. These sub-segments offer pockets of value within the FIG sector which have delivered strong returns for investors. It is also worth noting that whilst traditional FIG businesses have, at times, been more difficult to scale with the PE model, there have been some notable successes for specialists backing challengers and neo-banks.

The value of a FIG-specialist approach

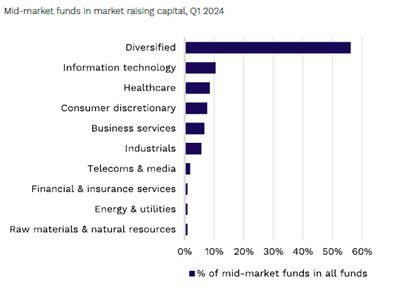

Across the European mid-market, the investor landscape differs between FIG and other sectors targeted by PE investors. Sector specialism has become more prevalent in the market, as managers seek to differentiate from competitors and win over management teams, leveraging deep sector experience and expertise. However, there continues to be a relatively small proportion of sector specialists within the FIG market. This can be seen in Figure 2, which shows the low proportion of specialist FIG funds fundraising in Q1 2024. Whilst this data is only reflective of a point in time, it is illustrative of a broader trend.

This is consistent with the evolution of the sector, where an increasing proportion of PE activity within FIG is focused on asset-light businesses. As these businesses often straddle sectors, managers with multi-sector expertise are well-placed to navigate the complexity of the financial sector whilst driving value creation. However, there remains value in a FIG sector specialist approach in terms of clarity of sourcing focus, positioning with intermediaries, sellers and management teams, sub-sector networks and value creation throughout the ownership period.

Figure 2: Sector specialism across the European mid-market (Source: Preqin, 2025).

Opportunities brought forth by structural change

Several strategies have proven popular with experienced investors in the financial sector, such as consolidation plays in the fragmented accounting industry and complex carve-outs from large financial institutions, as they seek to simplify and re-focus. Similarly, structural change within the financial sector has unlocked new opportunities for investors.

Digital transformation: Financial institutions have recognised the value of technology to drive operational efficiency, ensure compliance with regulatory requirements and engage more effectively with customers. Given few have the requisite skills to build proprietary solutions, there has been significant outsourcing from these institutions to third-party financial software specialists.

Fragmentation of insurance brokerage: The importance of scale and breadth of offering for insurance brokerage platforms has become apparent over time, with many smaller, independent brokers facing margin pressures due to an increased regulatory burden. As the market remains highly fragmented, the opportunity for consolidation, combined with strong market growth and sticky client relationships, makes insurance brokerage a compelling sub-sector for PE investment.

Democratisation of finance and increasing demand for advice: Demand for wealth management and financial advice has been increasing strongly in recent years, underpinned by ageing populations globally, pension reforms and the well-documented ‘Great Wealth Transfer’. Wealth management platforms have piqued the interest of PE managers given strong fundamentals, such as strong organic growth and high cash conversion, as well as high fragmentation in the market, offering scope for consolidation.

The evolution of the FIG sector and the emergence of innovative, capital efficient financial technology and services businesses has reignited interest in the sector amongst mid-market private equity investors. The market continues to evolve, with new opportunities arising from regulatory change and the structural trends outlined above which underpin activity in the market.

Patria GPMS partners with sector specialists across the financial sector, both pure-play and multi-sector, who have proven their ability to originate compelling deal flow and deliver strong returns. We continue to see the financial sector as an attractive hunting ground for these managers given market developments and the rich opportunity set of asset-light financial service and technology businesses.

Reference List:

1. Private Equity International, 2023. Source: The rise of sector specialists

2. Baird, 2025. Source: 12 Predictions for European Private Equity Activity in 2025 | Baird

3. Preqin, 2025. Source: Preqin 2025 Global Report: Private Equity

4. Ashurst, 2025. Source: Private equity and financial services: predictions for 2025