Secondaries market is fast evolving to match the needs of the market

August 06, 2025

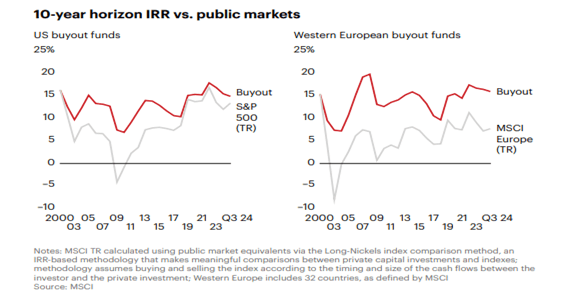

Global private equity buyouts have generated consistently strong returns over the last 25 years, with meaningful outperformance against public markets across all time periods, even in the globally volatile post-COVID years.

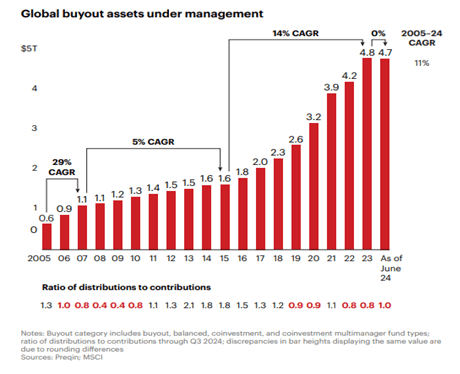

This outperformance has driven huge inflows into the buyout asset class, particularly in the lower interest rate environment of 2016-2022.

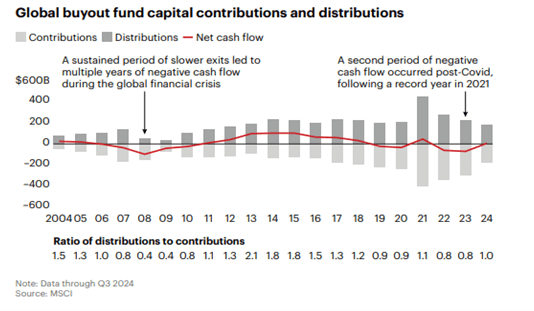

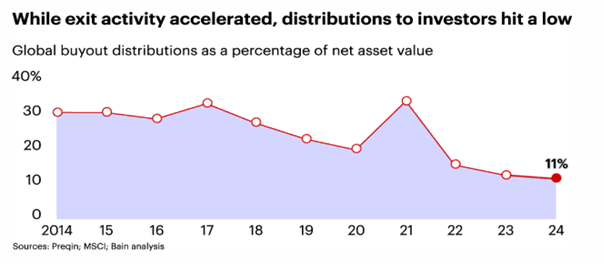

The years that followed were remarkable, with private equity demonstrating great consistency and growth in deployment, value creation, returns and importantly distributions. The growing inflow of capital resulted in a peak in buyout deal value, with >$2.5 trillion invested into new buyout deals globally in the 2019-2022 period alone. Admittedly, the asset class was also taking advantage of benign exit markets and doing its job of returning capital back to its loyal investors, with exit values of >$2.5bn in the 2019-2022 period, a signal of the outstanding returns being generated and the significant trade and public market interest in the high quality inventory of privately owned companies.

What we didn’t know in 2022, was that we were about to enter a period of unprecedented macro and geopolitical volatility, with inflationary challenges across developed markets, fast rising interest rates, tighter monetary policy, ongoing wars in Ukraine and the Middle East, and then the unexpected US tariffs in 2025. This uncertainty continues to persist and is keeping M&A markets on tenterhooks.

Distribution activity is ultimately the lifeblood of the private equity sector, validating holding valuations and driving renewed and growing investment into the asset class. Particularly in portfolios which are diversified by vintage year, strong returns and distribution levels can drive periods of net cash positive inflows to limited partners, for example the 8 year net cash positive run for the industry from 2011 to 2018.

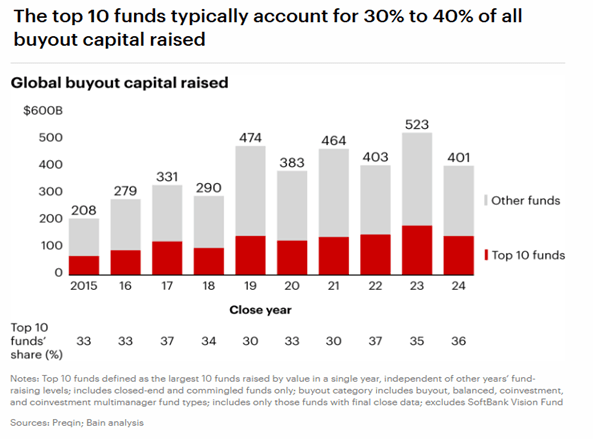

Investors continue to have strong appetite to allocate to the private equity asset class, as demonstrated by consistent buyout fundraising in 2023, but we are now starting to see the impact of the slowdown in distributions, with a 23% year on year fall in global buyout fundraising in 2024.

With public markets shrinking, and arguably the highest quality companies staying private for longer, we are convinced of the quality of companies remaining in private equity portfolios, especially in the innovative, resilient, secular growth sectors such as technology, healthcare, financial services and consumer staples.

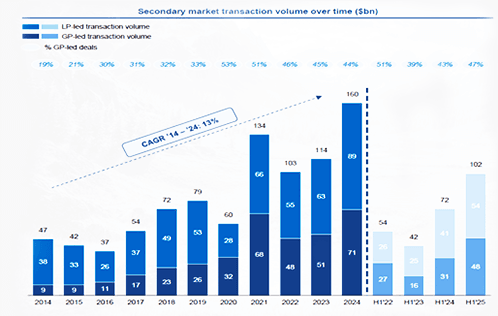

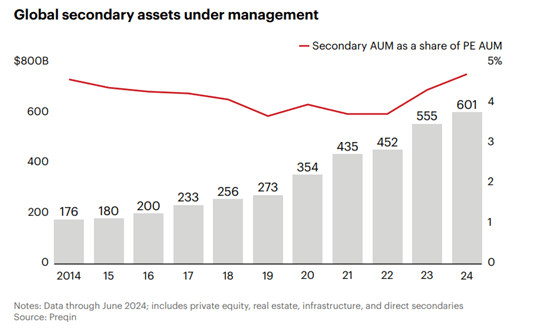

Naysayers who criticize the private equity industry for this slowdown in exit and distribution activity usually fail to recognize the incredible growth and evolution seen in the private equity secondary market over the last 20 years, reaching a record transaction volume of $160bn in 2024, and will surpass $200bn in transaction volume for the first time in 2025, over five times the market size in 2016.

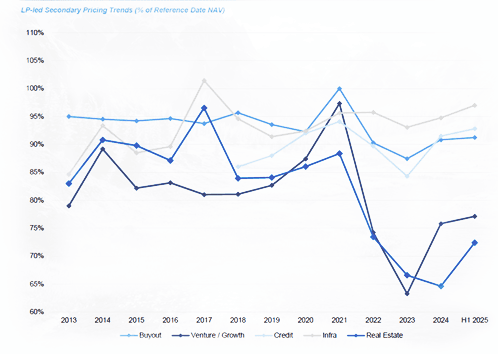

Of course, these pricing levels demonstrate that secondary market buyers have strong confidence in the quality of companies held in private equity buyout portfolios and the future upside potential. A vibrant secondary market is a vital tool in any mature market.

However, looking under the skin, we believe this average market pricing level is subsidised by two factors: 1) the majority of LP transaction volume is in large and mega cap funds, reflecting the fact that >50% of capital raised today is focused on this segment (the allure of brand names and concentration of GP relationships, with the top 10 funds typically accounting for 30 to 40% of buyout capital raised; and 2) there is a huge growth in retail vehicles managed by secondary investors (>$80bn as at March 2025, and expected to grow significantly in the years ahead) who need to put capital to work and are focused on large and mega cap assets.

One fact is true for the private equity market today – and this applies to secondary market investors as well as direct buyout investors – only those managers who are able to deliver strong cash on cash returns (with a consistent flow of distributions) are likely to survive in the long run.

Of course, these pricing levels demonstrate that secondary market buyers have strong confidence in the quality of companies held in private equity buyout portfolios and the future upside potential. A vibrant secondary market is a vital tool in any mature market.

However, looking under the skin, we believe this average market pricing level is subsidised by two factors: 1) the majority of LP transaction volume is in large and mega cap funds, reflecting the fact that >50% of capital raised today is focused on this segment (the allure of brand names and concentration of GP relationships, with the top 10 funds typically accounting for 30 to 40% of buyout capital raised; and 2) there is a huge growth in retail vehicles managed by secondary investors (>$80bn as at March 2025, and expected to grow significantly in the years ahead) who need to put capital to work and are focused on large and mega cap assets.

For secondary market investors who can differentiate themselves from the crowd, for example by targeting the increasingly attractive mid-market and lower mid-market, where there are thousands of underlying managers and funds, the opportunity set and entry pricing can vary significantly compared to the mainstream market data presented above. This part is more relationship driven, with lower mid-market managers in particular typically very restrictive on who can buy into their funds, and deal sizes tend to be smaller and off the radar of large, multi-billion dollar secondary funds.

Another big factor in the growth of the secondary market in recent years has been the growth in GP led transactions, where high quality private managers seek to continue to hold their trophy assets in continuation vehicles, giving limited partners liquidity at or around net asset value, but allowing for the manager to hold the company for longer to drive more value for secondary investors and those limited partners who choose to re-invest. The alignment in these transactions tends to be very strong, with managers re-investing very significantly in the new continuation vehicles, and the incumbency factor (ie managers wanting to re-invest in companies they already know very well) seen as derisking by secondary market investors. GP led transactions are expected this year to reach c.45% of secondary market volume. While GP led transactions are providing an important liquidity route for managers and their limited partners (expected to represent >15% of private equity exits in 2025), all evidence suggests that the early returns in the GP led market (tracked since 2018) are strong in terms of realized returns (typically outperforming buyout funds) with low loss ratios. As an example, Patria GPMS has had several exits in 2025 from its GP led portfolio, with average returns of >3.0x MOIC.

Investors globally value the liquidity being offered through the private equity secondary market, but we are also seeing a steady increase in investors allocating capital to the private equity secondary sub-asset class. Investors are recognizing the consistency of returns and stronger cashflow profile offered by secondary funds, but are also recognising the quality of the private company inventory held by private equity funds globally. Accessing these companies through the secondary market – both LP led and GP led transactions – arguably represents an attractive way to grow exposure to, or enter, the private equity asset class, especially as we expect exit markets to become unblocked and accelerate in the years ahead.

One fact is true for the private equity market today – and this applies to secondary market investors as well as direct buyout investors – only those managers who are able to deliver strong cash on cash returns (with a consistent flow of distributions) are likely to survive in the long run.